non filing of income tax return notice under which section

Non-filing of Income Tax returns is an unlawful act and can attract serious consequences to the tax-payer. ITAT Read Order By Taxscan Team - On August 15 2020 1017 am.

How To Respond To Non Filing Of Income Tax Return Notice

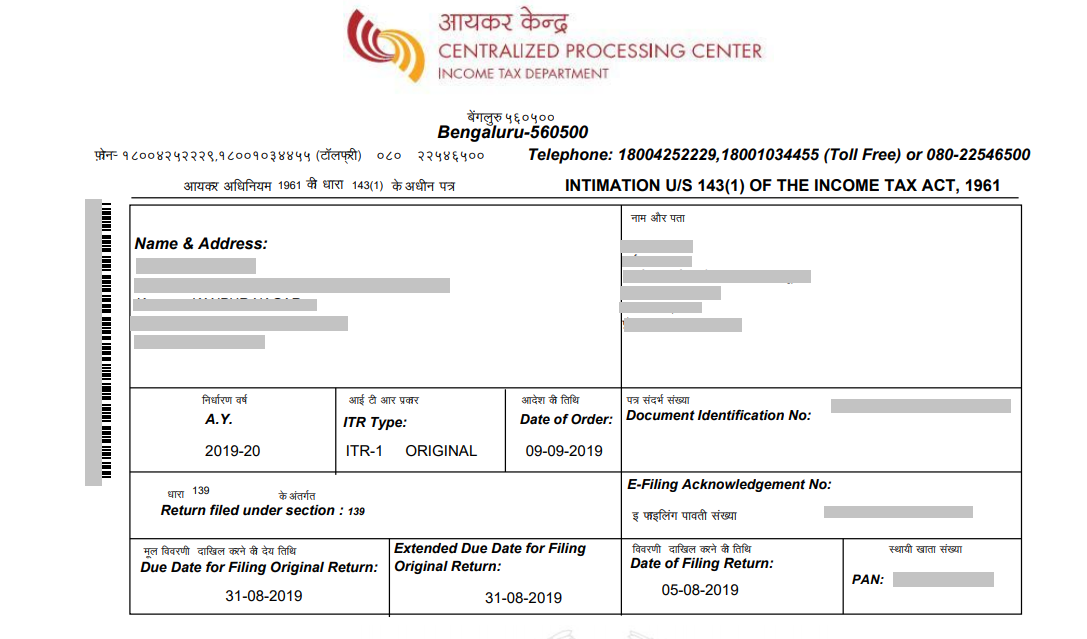

Now it is important to understand that notice under section 1431 and 1431a are two different notices and the way of dealing them is also different.

. In the given facts ITAT find that there was a reasonable cause with. The Income Tax Dept collects information through various sources and then based on their own analysis send notices to people who have carried out specified transactions. Even if you have genuine reasons for not filing the income tax returns like your income for the financial year being under the basic exemption limits due to loss of job or less profits booked in business it is still recommended to file.

Click on Compliance Menu Tab. Gives you a period of 15 days to correct the mistake. It often happens that while filing income tax returns we omit things or commit some mistakes.

Is your 10-digit customer number. Give a notice under section 112a shall furnish it electronically on or before the date of filing the return of income. Here you can view information about your non-filing status.

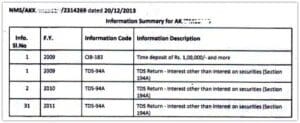

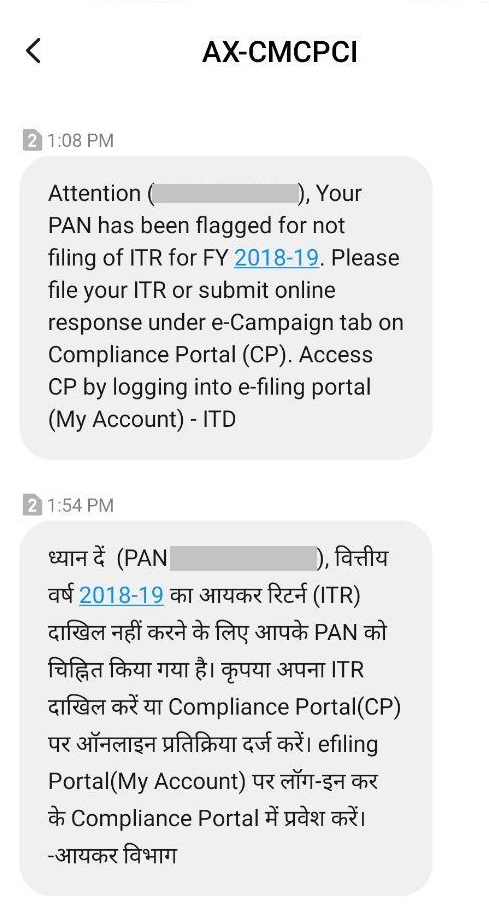

Ad File 1040ez Free today for a faster refund. Under section 1421 the Assessing Officer can issue notice asking the taxpayer to file the return of income if he has not filed the return of income or to produce or cause to be produced such accounts or documents as he may require or to furnish in writing and verified in the prescribed manner information in such form. Compliance Income Tax Return filing Notice This notice is sent to people by the Income Tax Dept if they think that the person has some taxable income but the ITR has not been filed for such income.

Applicability of ITR 1 SAHAJ Return Form ITR 1 SAHAJ can be used by a ordinarily resident individual whose total income includes. AO can issue notice us 142 1 if the return is not filed before the time allowed us 139 1. Section 139 9 of the Income Tax Act 1961 states that when a return is found defective the AO.

May lead to Best judgment assessment by the AO us 144. A Re-assessment proceeding also referred as re-opening of the assessment is initiated by the assessing officer when he has reasons to. Click on View and Submit Compliance to submit your response to the non-filing compliance notice.

Once received you need to respond to it within 15 days from the date of receiving the notice. Complete Lines 1 4 following the instructions on page 2 of the form. Carry forward of Losses not allowed except in few exceptional cases.

Penalty us 270A which is equal to fifty. Many taxpayers have received notice under section 1431a after filing their Income-tax returns for AY 2017-18 or AY 2018-19. In most of the cases the IT department sends notices by emails or by SMS.

Please prepend a zero to your student ID ie. Notice for Delayed ITR Filing. You can respond to the notice through your income tax e-Filing Account.

You can find another option view my submission. Download IRS Form 4506-T. You get a defective return notice under section 139 9 of the Income Tax Act.

Section 273B provides that no penalty shall be imposed inter alia us271F where the assessee establishes a reasonable cause for failure referred to in said section. If any individual or non-individual tax assessee has not filed tax returns within the specified deadline Section 139. These mistake s make your return defective and youre issued a notice of defective return us 139 9.

Notice for Tax Credit Mismatch. Notice for Non-Filing of Income Tax Return. Notice Under Section 1421.

So one should not get confused between the two. Notice for Non-Payment of Self Assessment Tax. Select the checkbox on the right hand side for Verification of Nonfiling.

If you do not file the income tax return in the correct form you will receive a defective return notice from the income tax department. C onsequences of non-filing of Income Tax Return. How to reply to non-filing of Income Tax Return Notice AY 2019-20.

If the Income Tax return is not furnished by the assessee within the timeframe underlined in the notice issued under Section 148 by the presiding Assessing Officer the assessee shall be made to pay interest under Section 2433 for late filing of Income Tax return or for not filing of Income Tax return if the income has already been determined under Section. No Penalty If Assessee has reasonable cause for non-filing of Income Tax Return. Notice for Non-Disclosure of Income.

There is no need of personal presence in this matter. January 23 2019. If you have not filed your return at all or by the end of the assessment year be prepared to get handcuffed because the Income Tax Department can slap you a notice of prosecution us276CC of the Act which provides for a rigorous imprisonment upto 7 years and with fine.

The Pune bench of the Income Tax Appellate Tribunal ITAT has held that no penalty under section 271F of the Income Tax Act 1961 is leviable since the assessee was under an impression that the sale proceeds. Income Tax Notice Reply Letter Format Under Section 2211. Section 139 of the Income Tax Act 1961 contains various provisions related to late filing of various income tax returns.

The issue of a notice under section 148 of the Income-tax Act the Act calling upon the Taxpayer to file a return of income for the year specified in the notice is the starting point of the Re-assessment Re-audit proceedings. As per the provisions of sec 139 1 of The Income Tax Act 1961 any person under. If you are reporting only Canadian-source income from taxable scholarships fellowships bursaries research grants capital gains from disposing of taxable Canadian property or from a business without a permanent establishment in Canada including a non-resident actor electing to file under section 2161 or if you are filing an elective return under section 217 of the Income.

1 Income from salarypension.

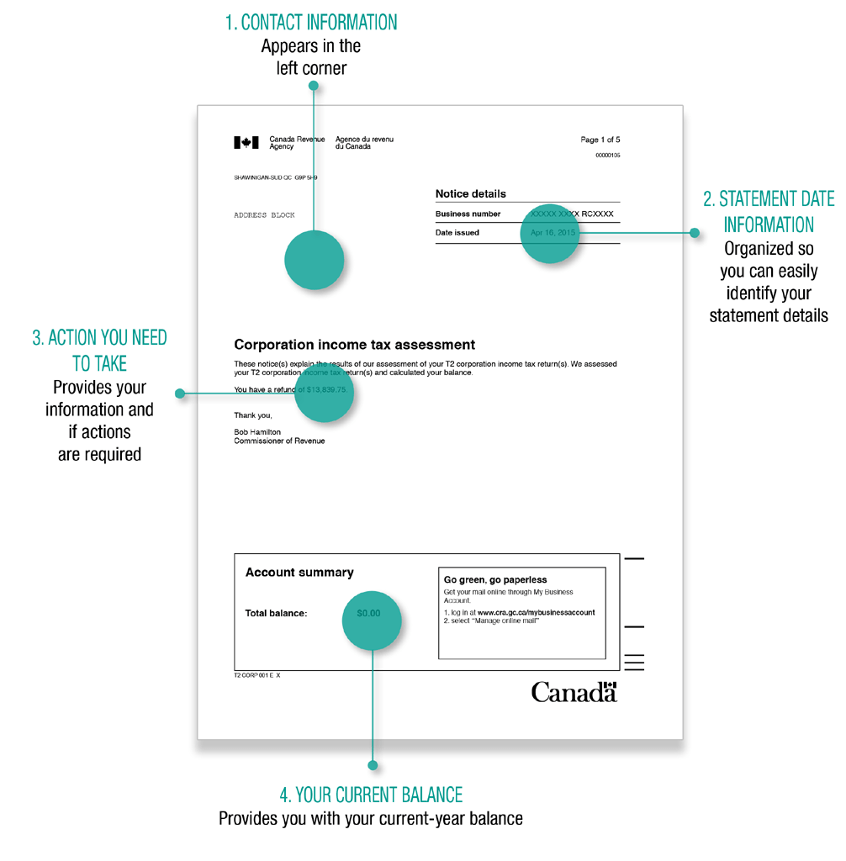

What Is A Notice Of Assessment And T1 General Mortgage Brokers Network

Notice For Not Filing Income Tax How To Respond To It Learn By Quickolearn By Quicko

How To Respond To Non Filing Of Income Tax Return Notice

Income Tax Assessment Taxbuddy

How To Respond To Non Filing Of Income Tax Return Notice

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

All You Need To Know About Income Tax Notice Paisabazaar Com

How To Respond To Non Filing Of Income Tax Return Notice

Income Tax Assessment Taxbuddy

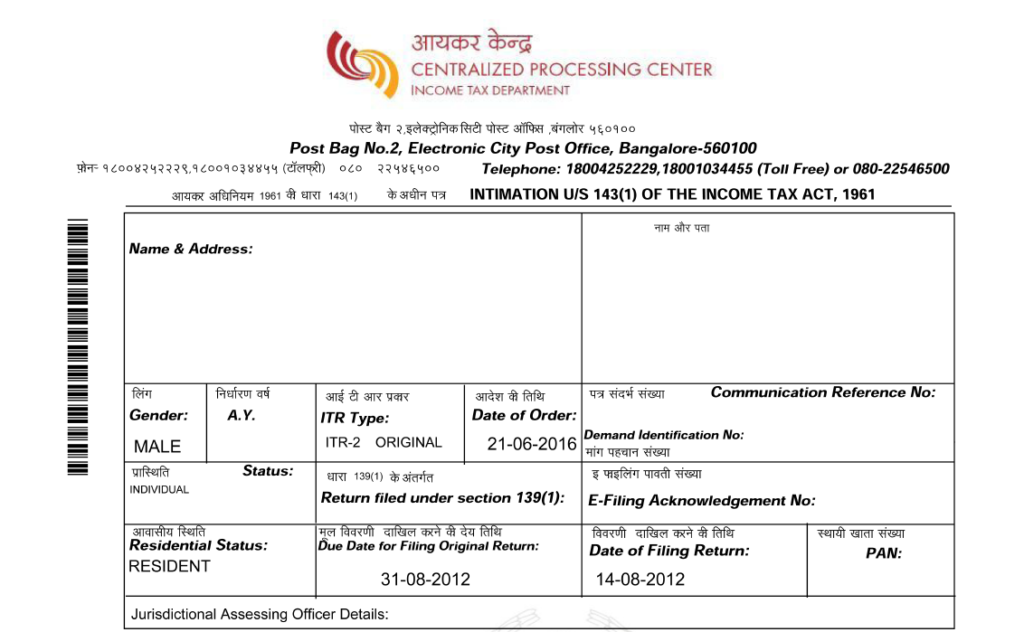

Processing And Intimation Taxbuddy

Irtf File A Return Example Ncdor

How To Handle Income Tax It Department Notices Eztax India

Notice Of Assessment Overview How To Get Cra Audits

Notice Of Assessment Expert Fiscaliste

How Should You Respond To A Defective Income Tax Return Notice

Cra Notice Of Assessment Why It S Needed For Separation Divorce Fyi

How To Respond To Non Filing Of Income Tax Return Notice

Understand Income Tax Notices Learn By Quickolearn By Quicko

Non Filing Of Income Tax Returns Despite Earning Taxable Salary Kindly Refer To The Subject Noted Above 2 Section 1 Income Tax Return Income Tax Tax Return